|

Every April the rates for National Living Wage and National Minimum Wage change. Here are the rates that came into effect 1 April 2024:

0 Comments

Every April the rates change for National Living Wage and the National Minimum Wage. Here are the new rates coming into effect from 1 April 2022:

Recently the new National Minimum Wage Rates were announced. These hourly rates are the minimum wage you should be paid depending on your age and whether you're an apprentice.

The rates from 1 April 2021 are:

This represents a big increase for 23 & 24 year olds who were previously getting £8.20 under the National Minimum Wage rate for 2020, but have now been moved into the National Living Wage bracket. The government has announced the biggest cash increase of the National Living Wage ever.#

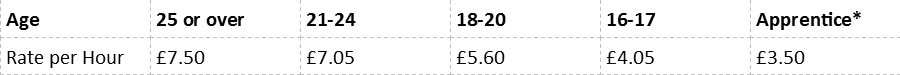

From April 2020, the new rates are:

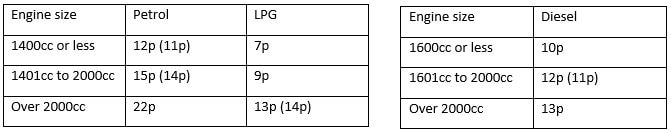

Further to these rises, the government has said it will press ahead with plans to allow workers over 21 to receive the National Living Wage by 2024 when it is set to reach £10.50 per hour. These rates are still below the "real living wage" as calculated by the Living Wage Foundation which equates to £9.30 or £10.75 for those in London. HMRC has issued details of the latest Advisory Fuel Rates for Company Cars which apply from 1 September 2018. For one month from the date of change, employers may use either the previous or new current rates, as they choose. Employers may therefore make or require supplementary payments if they so wish but are under no obligation to do either. The new rates are below (previous rate in brackets where there is a change): Hybrid cars are treated as either petrol or diesel cars for this purpose.

The Department for Education (DfE) has confirmed the annual updates to the Interest Rates and Thresholds of Income Contingent Student Loans.

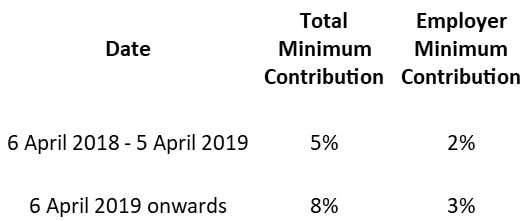

The current threshold for 2018-19 for Plan 1 is £18,330 and the DfE have confirmed that from 6 April 2019 the threshold will rise to £18,935 for Plan 1. Earnings above £18,935 will be calculated at 9%. The current threshold for 2018-19 for Plan 2 is £25,000 and the DfE have confirmed that from 6 April 2019 the threshold for post 2012 loans will rise to £25,725 for Plan 2. Earnings above £25,725 will be calculated at 9%. The DfE has introduced a new loan type from 6 April 2019, Postgraduate Loan (PGL). The threshold for 2019/20 is £21,000. Earnings above £21,000 for PGL will be calculated at 6%. With effect from 6 April 2018 the minimum pension contribution rates for auto enrolment have been increased and they will increase again next year: The minimum staff contributions depend on the amount paid into the pension by the employer, if the employer pays in more than the minimum, then the employee can pay in less to reach the total minimum level.

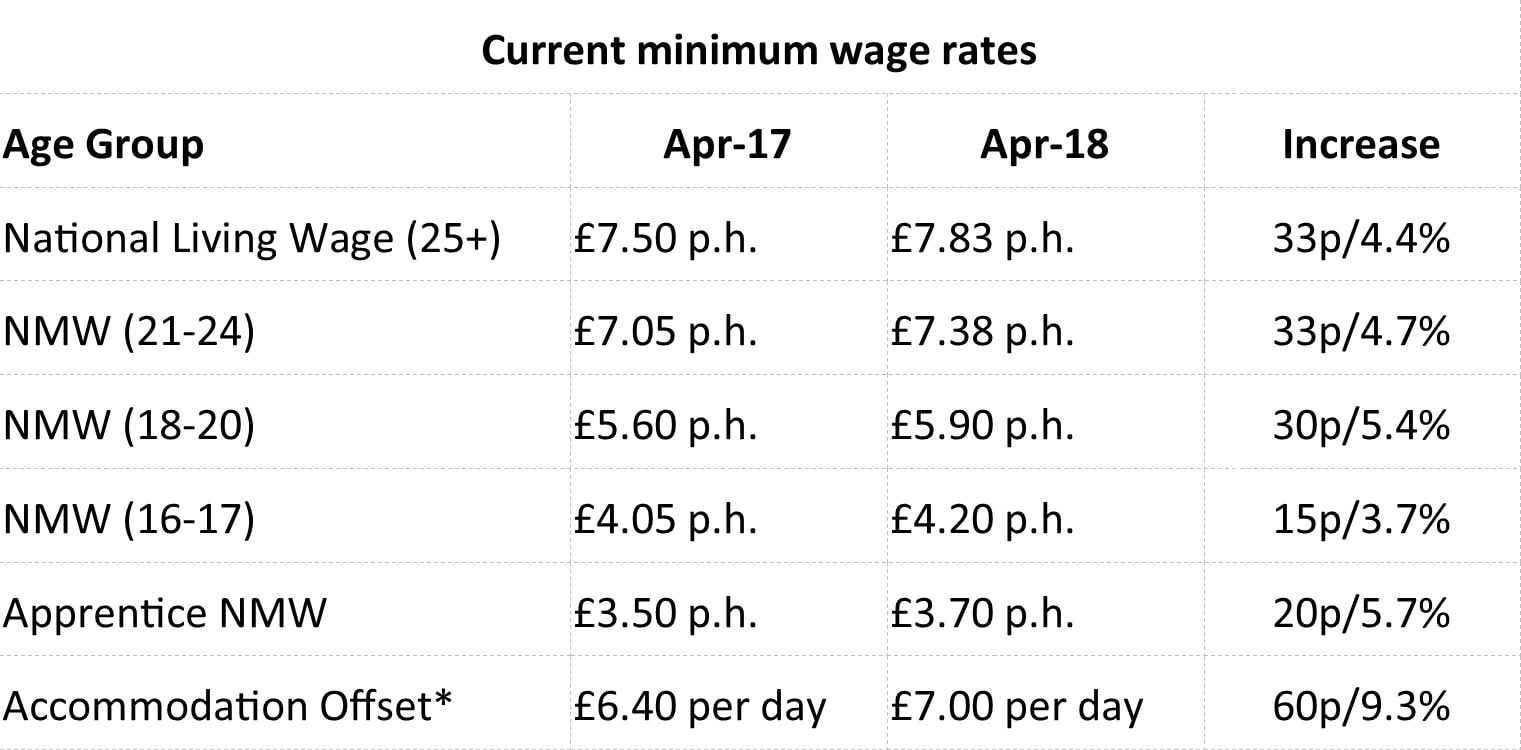

The National Minimum Wage (NMW) was first introduced on 1 April 1999 and since then has more than doubled. The rates of the NMW are set to increase again on 1 April 2018. Here are the rate increases.

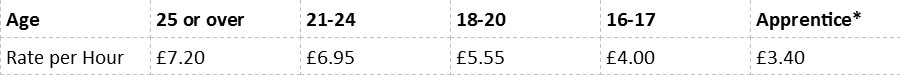

The National Minimum Wage (NMW) was first introduced on 1 April 1999 and since then has more than doubled. The rates of the NMW are set to increase again on 1 April 2017. We take a look at the rate rises. The Current National Minimum Wages rates are: *Rate applies to apprentices under 19, or 19 and over in the first year of apprenticeship. The National Minimum Wage rates from 1 April 2017 are: Employers using the minimum wage as part of their pay policy can now budget for the year ahead on the basis that the next review (and likely increase) of the minimum wage will not be until April 2018, providing some certainty.

The 25 or over rate is actually known as the National Living Wage (NLW) and was introduced April 2016. The Government's target is for the NLW to reach 60% of median earning by 2020 (around £8.80 per hour) subject to economic growth. Don't confuse NLW with the Living Wage The NLW is completely separate to the Living Wage, which is calculated according to the basic cost of living in the UK. The NLW places a statutory duty on employers to pay the relevant rate, whereas the Living Wage is a rate of pay that employers can voluntarily choose to pay their workforce. The Living Wage is set independently and updated annually by the Living Wage Foundation and has two separate rates. Since November 2016, the UK Living Wage is £8.45 per hour and the Living Wage for London, which covers all boroughs in Greater London, is £9.75 per hour. There is no penalty imposed on employers for not paying the Living Wage. HMRC compliance activity is on the increase You cannot contract out of paying workers the relevant minimum wage, even if a worker agrees to this in order to avoid losing their job or having working hours reduced. Any agreement made would be null and void. There are no excuses for underpaying workers what they are legally entitled to. No business is exempt from the minimum wage law, regardless of size or level of turnover. Employers must also be mindful that when seeking to take on new workers not to actively target younger people under the age of 25 in order to reduce employment costs, as this could lead to claims of age discrimination being made by potential workers. The HM Revenue & Customs (HMRC) enforcement budget was increased from £13 to £20 million in April 2016, increasing the number of compliance officers available to investigate NMW complaints. An additional £4.3 million in enforcement funding was announced in the last Autumn Statement. The Government is also to spend £1.7 million on an awareness campaign to ensure workers know how much they are legally entitled to. Every call to HMRC is followed up by a compliance officer. Furthermore, since October 2013, the Government has under its current naming policy issued a press release “naming and shaming” 687 employers for not paying the minimum wage, with total arrears of over £3.5 million paid to underpaid workers and total penalties imposed on employers of over £1 million. Compliance action on employers from HMRC is no idle threat. What if the minimum wage is not paid? Employers who discover they have paid a worker below the relevant hourly pay rate must pay any arrears immediately. If HMRC discovers that an employer has not been paying the correct rates, there will be a penalty imposed. As part of an HMRC, check into whether the minimum wage has been paid or not, compliance officers can request that employers undertake a self-review of records before any visit takes place. This exercise has the advantage that if an employer discovers underpayments of the minimum wage as part of the self-review and subsequently pays all the arrears to their workers, then a penalty will not be imposed and the business will not be “named and shamed” by HMRC. Penalties for minimum wage underpayment The financial penalty is calculated as a fixed percentage of the total underpayments (unpaid wages owed to workers) shown on a notice of underpayment issued by HMRC. Different penalty percentages apply as follows for pay reference periods starting:

Is doing your payroll causing you stress?

Are you getting close to your staging date for auto enrolment? Outsource to us and we will take away the strain of payroll and auto enrolment. Our fully outsourced payroll solution includes integrated auto enrolment, so your workplace pension requirements are taken care of in one process. We offer a friendly personal service provided by experience payroll professionals who specialise in dealing with payrolls from 1 to 100 employees along with all that entails, such as, pension deductions, holiday pay, overtime, maternity pay, sick pay etc. We will ensure all real-time information reporting is done on time to HMRC and with the introduction of auto enrolment this is a great time to pass the burden of payroll and pensions to a specialist like ourselves. When it is time for you to begin auto enrolment, we can assess your workforce for eligibility, produce the letters that need to be sent to your employees and then arrange for the correct deductions to be made. We can then produce the necessary reports for pension providers to be uploaded. On top of all that, we can set up a NEST pension scheme for your business and run it for you, so you have nothing to worry about. This is what sets us apart from many other payroll teams, as most are not ready for auto enrolment and cannot carry out the full administration of a pension scheme for you whereas we keep it all under one roof giving you a simple cost effective solution linking payroll, employee assessment, pension set-up and administration as well as ongoing pension support and employee communication. How do I sign up? We provide a free up front quote. We will discuss with you your requirements to find out exactly what you require and then give you your bespoke quote. Unlike many other payroll providers, we do not charge a set-up fee. Just give us a call on 020 8317 6460 or complete our Contact Us form. The information we are likely to ask for includes: frequency of payroll – monthly, weekly or 4 weekly; number of employees; pension scheme set-up required?; type of pay – hourly, salaried; any other regular additions/deductions? |

AuthorPaul Hills Archives

April 2024

Categories

All

|

|

|

©2024 SWPAY. All rights reserved. SWPAY is a service provided by Simpson Wreford LLP, Chartered Accountants

Wellesley House, Duke of Wellington Avenue, Royal Arsenal, London SE18 6SS |

RSS Feed

RSS Feed