|

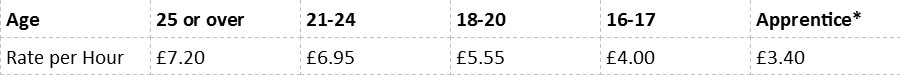

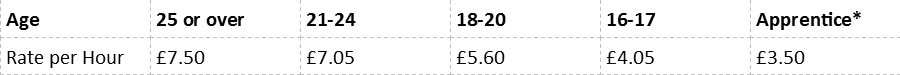

The National Minimum Wage (NMW) was first introduced on 1 April 1999 and since then has more than doubled. The rates of the NMW are set to increase again on 1 April 2017. We take a look at the rate rises. The Current National Minimum Wages rates are: *Rate applies to apprentices under 19, or 19 and over in the first year of apprenticeship. The National Minimum Wage rates from 1 April 2017 are: Employers using the minimum wage as part of their pay policy can now budget for the year ahead on the basis that the next review (and likely increase) of the minimum wage will not be until April 2018, providing some certainty.

The 25 or over rate is actually known as the National Living Wage (NLW) and was introduced April 2016. The Government's target is for the NLW to reach 60% of median earning by 2020 (around £8.80 per hour) subject to economic growth. Don't confuse NLW with the Living Wage The NLW is completely separate to the Living Wage, which is calculated according to the basic cost of living in the UK. The NLW places a statutory duty on employers to pay the relevant rate, whereas the Living Wage is a rate of pay that employers can voluntarily choose to pay their workforce. The Living Wage is set independently and updated annually by the Living Wage Foundation and has two separate rates. Since November 2016, the UK Living Wage is £8.45 per hour and the Living Wage for London, which covers all boroughs in Greater London, is £9.75 per hour. There is no penalty imposed on employers for not paying the Living Wage. HMRC compliance activity is on the increase You cannot contract out of paying workers the relevant minimum wage, even if a worker agrees to this in order to avoid losing their job or having working hours reduced. Any agreement made would be null and void. There are no excuses for underpaying workers what they are legally entitled to. No business is exempt from the minimum wage law, regardless of size or level of turnover. Employers must also be mindful that when seeking to take on new workers not to actively target younger people under the age of 25 in order to reduce employment costs, as this could lead to claims of age discrimination being made by potential workers. The HM Revenue & Customs (HMRC) enforcement budget was increased from £13 to £20 million in April 2016, increasing the number of compliance officers available to investigate NMW complaints. An additional £4.3 million in enforcement funding was announced in the last Autumn Statement. The Government is also to spend £1.7 million on an awareness campaign to ensure workers know how much they are legally entitled to. Every call to HMRC is followed up by a compliance officer. Furthermore, since October 2013, the Government has under its current naming policy issued a press release “naming and shaming” 687 employers for not paying the minimum wage, with total arrears of over £3.5 million paid to underpaid workers and total penalties imposed on employers of over £1 million. Compliance action on employers from HMRC is no idle threat. What if the minimum wage is not paid? Employers who discover they have paid a worker below the relevant hourly pay rate must pay any arrears immediately. If HMRC discovers that an employer has not been paying the correct rates, there will be a penalty imposed. As part of an HMRC, check into whether the minimum wage has been paid or not, compliance officers can request that employers undertake a self-review of records before any visit takes place. This exercise has the advantage that if an employer discovers underpayments of the minimum wage as part of the self-review and subsequently pays all the arrears to their workers, then a penalty will not be imposed and the business will not be “named and shamed” by HMRC. Penalties for minimum wage underpayment The financial penalty is calculated as a fixed percentage of the total underpayments (unpaid wages owed to workers) shown on a notice of underpayment issued by HMRC. Different penalty percentages apply as follows for pay reference periods starting:

0 Comments

|

AuthorPaul Hills Archives

April 2024

Categories

All

|

|

|

©2024 SWPAY. All rights reserved. SWPAY is a service provided by Simpson Wreford LLP, Chartered Accountants

Wellesley House, Duke of Wellington Avenue, Royal Arsenal, London SE18 6SS |

RSS Feed

RSS Feed