|

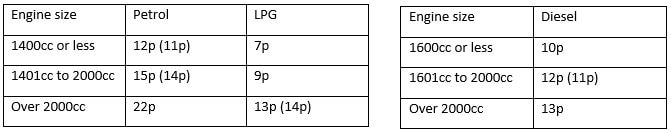

HMRC has issued details of the latest Advisory Fuel Rates for Company Cars which apply from 1 September 2018. For one month from the date of change, employers may use either the previous or new current rates, as they choose. Employers may therefore make or require supplementary payments if they so wish but are under no obligation to do either. The new rates are below (previous rate in brackets where there is a change): Hybrid cars are treated as either petrol or diesel cars for this purpose.

0 Comments

Leave a Reply. |

AuthorPaul Hills Archives

April 2024

Categories

All

|

|

|

©2024 SWPAY. All rights reserved. SWPAY is a service provided by Simpson Wreford LLP, Chartered Accountants

Wellesley House, Duke of Wellington Avenue, Royal Arsenal, London SE18 6SS |

RSS Feed

RSS Feed