|

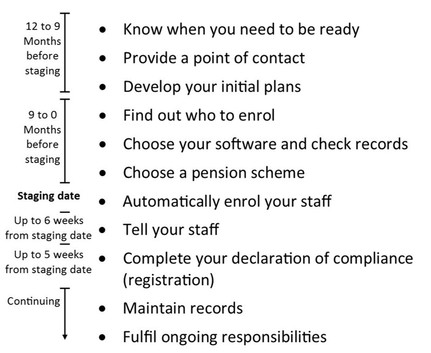

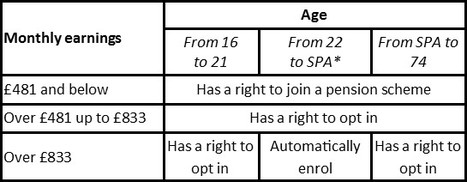

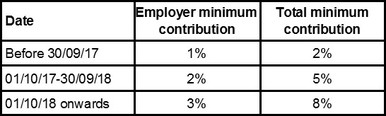

Auto enrolment and you The law on workplace pensions has changed. All employers are legally required to automatically enrol certain staff into a workplace pension scheme and make contributions. You will also have to tell your staff about the scheme you put them in and allow other staff to join if they request to do so. The Pensions Regulator is the UK regulator of work-based pensions schemes. This post contains information and guidance provided by the regulator to help you comply with the law. Auto Enrolment: The Main Steps Know when you need to be ready You must be ready to start enrolling staff from your staging date. This date will appear on letters from The Pensions Regulator to you about auto enrolment. If you don’t have a copy of that letter, you can find out your staging date by entering your PAYE reference into a tool on The Pensions Regulator website: www.tpr.gov.uk/staging-date Provide a point of contact There are several things that you need to do to be ready for auto enrolment. You are able to sign up to The Pensions Regulator emails which provide help and guidance. To make sure the right person in your organisation receives these email updates go to: www.tpr.gov.uk/nominate-contact Develop your initial plans Employers have found that they need to start preparing up to a year prior to their staging date, so you should start making plans in good time. There is an auto enrolment planner on The Pensions Regulator website to help you to prepare. It shows you what you should do and by when as your staging date approaches: www.tpr.gov.uk/planner You will need to pay a regular contribution into the pensions of your eligible staff. To get an idea of the amount, you may find The Pensions Regulator online calculator useful: www.tpr.gov.uk/calculate There may be other costs to consider, such as setting up your workplace pension scheme, getting the right software to manage auto enrolment and any independent advice you might decide to take. Find out who to enrol You will have to assess all your staff for eligibility but you may not have to automatically enrol all of them. The table below outlines your duties depending on the salary of your staff member. Figures correct as of 2014/15. *SPA= state pension age It’s against the law to take any action to induce anyone to opt out. Examples of this could include persuading or forcing staff to opt out by offering them a cash bonus to do so, or withholding a pay increase until they opt out. Choose your software and check records You’ll need to know who has to be automatically enrolled and who can ask to join your pension scheme. Payroll software which is specifically tailored to auto enrolment will help you keep track of the ages and earnings of all your staff and will tell you what you need to do for each of them. If you run your own payroll, you may already know whether this is built in. If someone else manages your payroll for you, you will need to ask them. You should also test your software well ahead of your staging date, to make sure it works. Taking the time to get your staff and payroll records in order ahead of your staging date is essential. You must be able to provide information to your workplace pension scheme in the correct format. Make sure the necessary records are easily to hand and that you have correct information about your staff before your staging date, including; dates of birth, National Insurance numbers and latest contact details. Choose a pension scheme If you have an existing scheme for your workplace (perhaps called a ‘stakeholder scheme’) you should check with your pension provider to see if you can use it for auto enrolment. If you need to open a new scheme, make sure you approach a pension provider in good time because they will be taking on thousands of employers in the coming months. Don’t leave it too late. The Government has set up a pension scheme called the National Employment Savings Trust (NEST) to accept all employers wishing to use the scheme for auto enrolment. This is one option, and there are other providers available. Automatically enrol your staff At your staging date you will need to identify which members of staff you will automatically enrol and which will have a right to join your workplace pension scheme on request. By this point you will already know what information your scheme provider wants from you, so make sure you send this to them promptly. Make sure you pay the contributions across to the pension scheme before the deadline your provider has given you. Tell your staff After your staging date, you must write to your staff about how auto enrolment affects them. Your pension scheme provider may provide template letters for you to use, or you could use The Pensions Regulator website: www.tpr.gov.uk/writing Complete your declaration of compliance You must complete your declaration of compliance when you’ve automatically enrolled your members of staff. This confirms to The Pensions Regulator that you have fulfilled your legal duties. Maintain Records As with real-time PAYE, you must keep records of your auto enrolment activities. This will include the information you sent to your pension provider, and copies of any opt-out requests you receive. Fulfil ongoing responsibilities For auto enrolment there are minimum contributions you must pay in order to comply with your duties. These are a percentage of earnings and are shown in the table below. Your worker may also pay pension contributions, which you will need to make sure you deduct and pay to the scheme on time.

Auto enrolment is not just something that happens at your staging date - it is an ongoing duty. You’ll need to check every payday to see whether any of the members of staff who weren’t automatically enrolled are now entitled to be put into the pension scheme (for example reached 22). After you have automatically enrolled your staff members, they may ask to ‘opt out’ of the pension scheme. You must then stop deductions of contributions and arrange a refund of any contributions they have paid to date. Staff who have not been automatically enrolled may ask to join your workplace pension scheme. If you receive such a request, your software should help you process this. SWPay: Helping you with Auto Enrolment Our payroll software is Auto Enrolment ready and is set up to produce the pension reports required by the following pension providers; Friends Life, Scottish Widows, Standard Life, NEST and The People’s Pension. Furthermore we are able to act as the Penson Administrator for your NEST scheme if you choose this option, which means we can carry out most of the onerous tasks that Auto Enrolment requires. We currently prepare the payroll for a large number of employers and already prepare pensions reports for a number of these. If we do not currently prepare the payroll for your employees, then we may be able to reduce the burden of these new regulations. Whether you have one employee or 100, we can prepare all the calculations for you, ensure all the data is RTI compliant, supply security payslips and even provide a payment service for paying your employees efficiently and on-time. Not only will this mean one less thing to worry about, it also allows your valuable time to be directed at more productive and profitable tasks. For further information about our Payroll Bureau service and how we can help you with Auto Enrolment please give us a call on 020 8317 6460 and we will be pleased to have a free consultation to discuss your situation.

0 Comments

Leave a Reply. |

AuthorPaul Hills Archives

April 2024

Categories

All

|

|

|

©2024 SWPAY. All rights reserved. SWPAY is a service provided by Simpson Wreford LLP, Chartered Accountants

Wellesley House, Duke of Wellington Avenue, Royal Arsenal, London SE18 6SS |

RSS Feed

RSS Feed